-Tom Collins

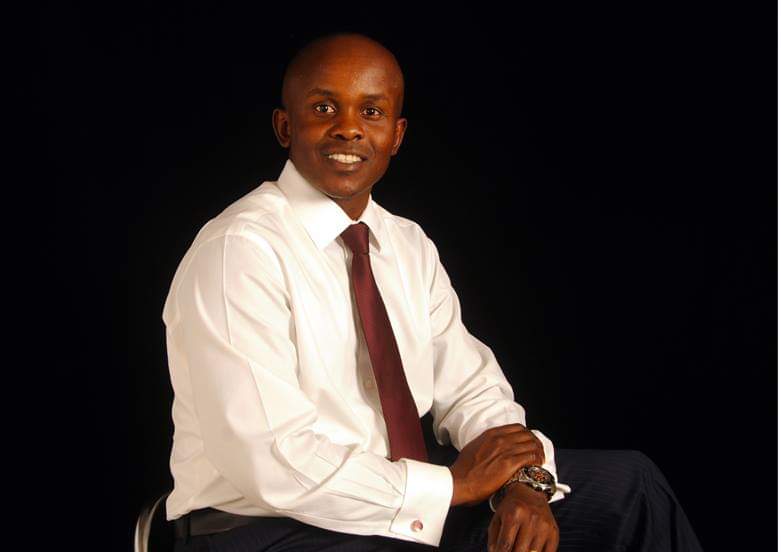

James Mworia of Centum

Centum, East Africa’s largest publicly listed investment firm, seems to turn everything it comes into contact with into gold. James Mworia, the company’s CEO, explains to Tom Collins what gives it the Midas touch.

Founded in Nairobi in 1967, Centum Investment has evolved into East Africa’s leading investment company, with assets worth over $1bn and a team of over 200 employees.

Listed on the Nairobi Securities Exchange (NSE) and the Uganda Securities Exchange (USE), Centum provides investors with a diverse portfolio of regional investment opportunities including real estate, infrastructure, FMCG, financial services, private equity, energy, agriculture and education.

The group’s half-year profit surged to $67.9m last year, up from $20.7m in a similar period the year before, primarily driven by the sale of Centum’s shares in three beverage firms.

Centum owned equity worth $6m in 2012 and sold those shares for $190m seven years later.

Along with top-line growth, the stake increased in value more than tenfold due to enhancement of efficiencies and margin increases which were driven by macro improvements in the economy that lowered the cost of doing business in Centum’s primary market, Kenya.

“If you look at the bottling sector, in 2012 we had a margin of 12%. By 2017 it was 26% so even though we have not been able to increase prices, there was a significant margin improvement because of improved efficiencies,”

CEO James Mworia tells African Banker from his top-floor office at the Two Rivers Mall in Nairobi – also one of Centum’s greenfield investments.

“The cost of doing business came down. When you have a reliable power supply you are not switching on your generator; when you have reliable water you are not using boreholes; when you have good roads you are able to consolidate better production; when you have access to capital you are able to consolidate distribution. All those small things come together if you look at an analysis of where our value came from.”

Mworia, who also serves as the chairman of a bank, chancellor at a university and previously as a director of the NSE, attributes these changes to the current President Uhuru Kenyatta administration, which has ramped up spending through increased borrowing and revenue collection since it came to power in 2013.

Kenya’s total debt now stands at around $60bn, which is around 60% of GDP compared to 40% in 2012.

Though this figure raises alarm for certain economists, Mworia believes the Kenyan private sector should support the government’s willingness to raise funds for large infrastructure projects which is where the majority of debt has been spent.

“We were the ones who originally asked for the improvement in infrastructure; it was not the government,”

he says.

“If you look at the various interventions made by the private sector, they voiced what was holding them back and the issues have been addressed. It wasn’t possible to achieve that without borrowing.”

The concern is that these infrastructure projects may take years to become profitable and to have a marked impact on the economy, Mworia admits.

Meanwhile the government must allocate a large portion of its budget to service previous debt, often financed by further borrowing.

This year’s predicted growth, 6% by World Bank estimates, will mainly be as a result of public spending on infrastructure and government, leading some to worry about the actual productivity of the private sector.

Beneficial spending patterns.

Yet the government’s spending patterns have been beneficial for companies working in sectors like infrastructure and real estate, which have seen massive investments over the past decade.

Real estate accounted for 51.6% of Centum’s portfolio assets in the last financial year, followed by 36.1% in private equity, 6.2% in marketable securities and 7.6% in development.

Many of Centum’s huge real estate development projects, including Two Rivers in Nairobi and Vipingo on the Kenyan coast, have benefited from road construction by the government or development finance institutions (DFIs).

While Two Rivers Mall is best known as one of Nairobi’s biggest and most modern malls, it sits on 10 acres of the expansive 101 acres development that also boasts a hotel, residential apartments and offices.

Centum began the greenfield project in 2010 as the master developer which included building a water treatment plant able to provide 3m litres of fresh water a day and installing a solar plant with 1MW capacity.

The Kenyan government was able to build the Northern Bypass and, more recently, the Westlands-Redhill Link Road, which act as some of the main arteries feeding into the mall in the south of Nairobi.

At the Vipingo development in Kilifi, Centum has constructed 624 modern houses which will benefit from the African Development Bank’s (AfDB) $345m construction of a road connecting nearby Mombasa with Tanzania.

Over 500 units have been sold in just one year at Vipingo and the Two Rivers is currently running at 80% occupancy, offering handsome returns for shareholders and investors.

Though Nairobi is currently suffering from an oversupply in the housing market which is likely to lower prices and returns, investors should look outside East Africa’s busiest capital city at a wide range of opportunities within the region, Mworia says.

“When people think about real estate – they look at what is happening in Nairobi,” he says.

“But the fact that the housing market is saturated does not mean that demand in other places is not there. In Kilifi and in Entebbe in Uganda we have sold a lot of units.”

Along with private equity investments including stakes in Sidian Bank and Isuzu East Africa, Centum has recently developed its portfolio in two new areas: education and agricultural exports.

In the last two years, Centum has invested considerably in exporting herbs like mint, parsley and tarragon to Europe.

Connecting smallholder farmers to higher value markets is an easy way to increase value, Mworia says.

Centum is also exploring opportunities in the education space, encouraged by the emerging regional trend of a younger population growing at a faster rate, and increasing urbanisation.

In 2018, Centum began the construction of the $20m Sabis International School in Nairobi.

Charging $8,000 a year in tuition fees, Mworia believes the institution will plug the education gap in Nairobi for aspirational parents who are not able to afford some of the more renowned schools which charge up to twice that price.

“We see opportunity at that price point, and even lower, which can still run profitably across the region,” he says.

Investment Theory.

A business leader who started his career as a filing clerk at Centum in 2001, Mworia describes how within the East African region, consumption-led sectors are the most attractive areas of investment as the demand for local goods and services is domestic.

“We are not an export-orientated economy, we are a local domestic economy,” he says.

“You are selling goods and services where the money ends up in the pockets of ordinary Kenyans as opposed to places like West Africa where you are exporting raw materials and the money ends up in government pockets.”

Kenya itself is fabled for its rapidly growing middle class which guarantees increasing demand and therefore net increases to Centum’s publicly traded securities in real estate, infrastructure, education, banking, transport and consumer goods.

Kenya’s diverse economy, which is not over-reliant on any one sector, is also a key bonus for investors who wish to avoid shocks.

The region was cushioned from the global slowdown which occurred across the rest of globe and in other parts of Africa as a result of the slump in oil prices.

Crowding Out.

Over the past five years, the main setback to the growth of Kenya’s private sector has been the lack of credit in the market. Though the reasons behind the liquidity crunch are manifold, one significant factor is the government’s propensity to borrow on the domestic market, which has crowded out the private sector.

“The solution is to figure out how the government can stay out of the domestic credit market for at least a year or two,” Mworia says.

“We have a very strong private sector, but the lifeblood of any market is liquidity and investors have flocked to government securities which has left little for domestic businesses.”

While loose monetary policy rates in Europe are causing investors to flock to emerging markets in search of better returns, Mworia believes the government should turn solely to the international markets to satisfy its borrowing needs.

Related posts

Global | Didi Angaye Earns A Distinction Award, Another Feather To The Cap

On a bright sunny day, in the month of July, 2024, the prestigious Staffordshire University located in the West Midlands of England organised its Award giving and Graduation ceremony to honour graduates of various educational programmes and courses which it offers. Didi Timipah Angaye,…

Olu Of Warri Bags Award In UK, Wife Advocates Return To Cultural Values

The Olu of Warri, Ogiame Atuwatse III, has received the Leadership and Community Development award at the 14th African Achievers Awards (AAA), which took place at the Parliament House, United Kingdom. The award was presented by a member of the House of Lords, London, Rt…

Brit Awards | Asake, Burna Boy And Other ‘New Cats’ Get Nominations

Nigerian singers Burna Boy, Asake, and Rema have been nominated for the 2024 Brit Awards. The nomination list for the annual music awards show was released on Wednesday 25, January 2024. Burna Boy and Asake made the ‘Best International Artiste’ category, while ‘Calm…

Brit Awards 2024 | The Full List Of Artist(e)s

This year’s Brits nominees have been revealed ahead of the ceremony in London in March. Dua Lipa is the first star confirmed to perform at the event – but how many awards is she up for? Musicians including Raye, Central Cee, J Hus and Blur are also…

Despite Increased Transfer Volume And Institutional Adoption, Bitcoin Stays Below $60K

Bitcoin’s price hovers around $59K as increased transfer volume indicates a stable demand among investors. CryptoQuant data indicates buyers are absorbing the panic selling pressure around the $57K price level. Bitwise’s latest report suggests that institutional investors are still buying Bitcoin despite the recent price…

Traders Focus On Meme Coins As Bitcoin, Ethereum And XRP Erase Recent Gains

Bitcoin, Ethereum and XRP dip under key support levels at $60,000, $2,600 and $0.60 respectively. Tron ecosystem’s meme launchpad SunPump generates over $1.1 million in revenue within twelve days of its launch. Tron network daily revenue reached a record high of $26.83 million on Tuesday,…

Top 10 Cryptocurrencies To Invest in January 2024

-Michael Adams From Bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, making it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies based on their market…

The Risk And Reward Of ChatGPT In Cybersecurity

Juan is an experienced CTO with a demonstrated history of working in the computer and network security industry. He is an information technology professional skilled in SAP and Oracle applications, computer forensics, vulnerabilities research, IPS/IDS and information security. Unless you’ve been on a retreat in…