–Hameed Ajibola Jimoh Esq.

Payment of tax is an obligation or duty of every Nigerian citizen and forms part of civic responsibilities of Nigerians. Nevertheless, the Covid-19 has grounded the economy globally by the infectious disease and having more cases being diagnosed in some States of Nigeria, including the FCT-Abuja. Italy has been rated as the most affected country of the world even worst than China where the said pandemic disease had arose from.

This paper is a candid advice to the Nigerian Government of both the Federal Government and the State Government as well as the Federal Capital Territory- Abuja, to extend the period of payment of the 2019 tax and to exempt tax for the year 2020 as the year 2020 is and shall be recorded as the year of Corvid-19 and a global economic melt-down.

According to the World Health Organisation-herein after referred to as WHO-, as contained on its website https://www.who.int/health-topics/coronavirus , Coronaviruses (CoV) are a large family of viruses that cause illness ranging from the common cold to more severe diseases such as Middle East Respiratory Syndrome (MERS-CoV) and Severe Acute Respiratory Syndrome (SARS-CoV). A novel coronavirus (nCoV) is a new strain that has not been previously identified in humans.

Coronaviruses are zoonotic, meaning they are transmitted between animals and people. Detailed investigations found that SARS-CoV was transmitted from civet cats to humans and MERS-CoV from dromedary camels to humans. Several known coronaviruses are circulating in animals that have not yet infected humans. Common signs of infection include respiratory symptoms, fever, cough, shortness of breath and breathing difficulties. In more severe cases, infection can cause pneumonia, severe acute respiratory syndrome, kidney failure and even death. Standard recommendations to prevent infection spread include regular hand washing, covering mouth and nose when coughing and sneezing, thoroughly cooking meat and eggs. Avoid close contact with anyone showing symptoms of respiratory illness such as coughing and sneezing.’

On the report watched on the Channels tv station as at the 22nd day of March, 2020, the detected cases of Covid-19 has been at the number of 27 across Nigeria. The Federal Government, State Government and the FCT-Administration have called for a short down of all schools, international flights, quarantine for at least 14 days and reduction in populated areas as well as reduction in numbers of worshippers in religious places across the Federation and many more measures at curbing this menace called Covid-19 are on the way until the lasting solution is discovered.

Nevertheless all these preventive measures, the far effect of this virus (which has no cure yet) on the economy cannot be over-emphasised! Market products and commodities have gone high. Many Nigerians could not freely socialize and a lot of far reaching measures have to be put in place. Also, while the 31st of March of every year and for this year, 2020, marks the end of the payment of the year 2019 tax and the calculation of the year 2020’s tax had commenced since the 1st of January, 2020, which is then payable on or before the end of the 31st day of March, 2021, personal income tax, citizens are likely to find it very difficult to pay their tax not out of desire but having regards to the current condition and effect of the Covid-19 on the individuals and the economy.

Considering and having regards to the present challenges created by this Corvid-19, it is my humble reasoning and advice therefore to the government at all levels to kindly extend the deadline for the payment of the year 2019 tax and to exempt Nigerians of the payment of the 2020 tax come the year 2021 as a way of cushioning and or reducing the effect of the Covid-19 on them and the unease it has brought to their life and their economy. At best, government might consider pardoning late payment for the year 2019’s and the year 2020’s taxes as doing this will be in the interest of justice, else, the condition of slow economy, no work, stay at home, non-payment of fees for services among others are likely to render almost a hundreds if not millions of Nigerians violators of tax laws for their failure to remit taxes.

Finally, it is my humbly plea to the government to consider the recommendations made by this paper and to make appropriate directives towards yielding to these kind pieces of advice in the interest of justice.

Email: hameed_ajibola@yahoo.com

Related posts

Brit Awards | Asake, Burna Boy And Other ‘New Cats’ Get Nominations

Nigerian singers Burna Boy, Asake, and Rema have been nominated for the 2024 Brit Awards. The nomination list for the annual music awards show was released on Wednesday 25, January 2024. Burna Boy and Asake made the ‘Best International Artiste’ category, while ‘Calm…

Brit Awards 2024 | The Full List Of Artist(e)s

This year’s Brits nominees have been revealed ahead of the ceremony in London in March. Dua Lipa is the first star confirmed to perform at the event – but how many awards is she up for? Musicians including Raye, Central Cee, J Hus and Blur are also…

The Miss Universe-Greatest Celebration of Women

-SOFIE ZERUTO The Miss Universe Organization is a global, inclusive of organizations that celebrates all cultures, backgrounds and religions. It creates and provide a safe space for women to share their stories and drive impact personally, professionally, and philanthropically. The women who participate in this…

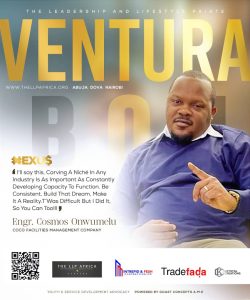

All Africa Music Awards; Categories and Regions

-MUSIC IN AFRICA All Africa Music Awards (also referred to as AFRIMA) is an annual awards event. The awards event was established by the International Committee AFRIMA, in collaboration with the African Union (AU) to reward and celebrate musical works, talents and creativity around the African continent while promoting…

Top 10 Cryptocurrencies To Invest in January 2024

-Michael Adams From Bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, making it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies based on their market…

The Risk And Reward Of ChatGPT In Cybersecurity

Juan is an experienced CTO with a demonstrated history of working in the computer and network security industry. He is an information technology professional skilled in SAP and Oracle applications, computer forensics, vulnerabilities research, IPS/IDS and information security. Unless you’ve been on a retreat in…

Explained – History Of Money From Fiat To Crypto

What is money? Money as a concept has been a cornerstone of human civilization and economic development. To start with the latter, money is a method of storing value and worth, and it also functions as a medium of exchange that allows individuals to exchange…

Studies Show That Nigerian Crypto Foreign Investment Is At A Record Low

Foreign direct investment in Nigeria fell by 33% last year due to a severe shortage of dollars, which discouraged crypto companies from expanding into the country. The largest economy in Africa has a foreign investment problem despite exponential growth in crypto adoption. The National Bureau…