When I started out trading back in 2020, there was the allure of starting with a small amount of money and turning it into a large fortune. Since then I have learned several ways of starting with a small amount of money, and growing it exponentially, without having to deal with the Pattern Day Trader Rule (PDT Rule) restrictions. What follows will be the best ways to avoid the PDT restrictions, but first, what is the PDT rule?

Pattern Day Trading Rule

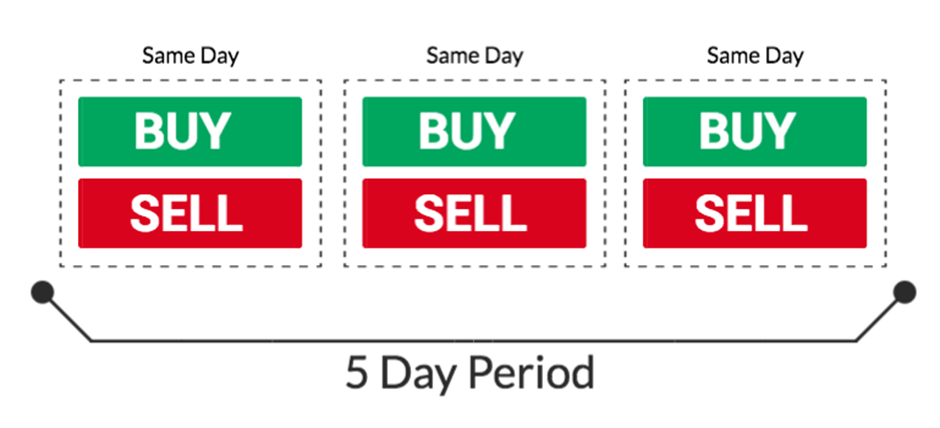

The PDT Rule:

A pattern day trader (PDT) is a trader who executes four or more day trades within five business days using the same account. Pattern day trading is automatically identified by one’s broker, and PDTs are subject to additional regulatory scrutiny and limitations.

Unfortunately, Pattern day traders are required to hold $25,000 in their margin accounts. If the account drops below $25,000, they will be prohibited from making any further day trades until the balance is brought back up.

Alternatives:

To Avoid the $25,000 requirements there are a few ways around to start trading now with as little as $50:

- Avoid intraday trades.

By not opening and closing a position within one day, you can avoid the PDT rule entirely. Only open and close trades when one day has passed, you can save up your 3-free intraday trades for emergencies when you need to get out of a position. - Trade Futures.

My favorite option is to trade the futures market, there are many brokers that let you trade futures with as little as $50. In the past I have grown accounts from $250 to $4,000 USD in just 2 short months. After trying futures and understanding the margin/movements you’ll probably be hooked just like me. Just be aware futures have a lot of leverage. - Trade FOREX.

Foreign exchange (FOREX) markets, similarly to futures, are exempt from capital requirements. This means you can start trading FOREX with very little money. This is often safer than futures, because futures have a lot of leverage. - Open an offshore trading account.

This is the real fourth option. However, I don’t really recommend this. Still, some traders might choose to do this because only US brokers have to follow the FINRA and SEC rules including PDT. This should be the last option because it is less safe than the others.

There we have it, my best options for new-traders to start with a small account and turn it into a large stockpile. It will take some time, but even if you only made 3% a day, you can turn $500 into $1,000,000 in one year! Pretty crazy to think about.

Related posts

Global | Didi Angaye Earns A Distinction Award, Another Feather To The Cap

On a bright sunny day, in the month of July, 2024, the prestigious Staffordshire University located in the West Midlands of England organised its Award giving and Graduation ceremony to honour graduates of various educational programmes and courses which it offers. Didi Timipah Angaye,…

Olu Of Warri Bags Award In UK, Wife Advocates Return To Cultural Values

The Olu of Warri, Ogiame Atuwatse III, has received the Leadership and Community Development award at the 14th African Achievers Awards (AAA), which took place at the Parliament House, United Kingdom. The award was presented by a member of the House of Lords, London, Rt…

Brit Awards | Asake, Burna Boy And Other ‘New Cats’ Get Nominations

Nigerian singers Burna Boy, Asake, and Rema have been nominated for the 2024 Brit Awards. The nomination list for the annual music awards show was released on Wednesday 25, January 2024. Burna Boy and Asake made the ‘Best International Artiste’ category, while ‘Calm…

Brit Awards 2024 | The Full List Of Artist(e)s

This year’s Brits nominees have been revealed ahead of the ceremony in London in March. Dua Lipa is the first star confirmed to perform at the event – but how many awards is she up for? Musicians including Raye, Central Cee, J Hus and Blur are also…

Despite Increased Transfer Volume And Institutional Adoption, Bitcoin Stays Below $60K

Bitcoin’s price hovers around $59K as increased transfer volume indicates a stable demand among investors. CryptoQuant data indicates buyers are absorbing the panic selling pressure around the $57K price level. Bitwise’s latest report suggests that institutional investors are still buying Bitcoin despite the recent price…

Traders Focus On Meme Coins As Bitcoin, Ethereum And XRP Erase Recent Gains

Bitcoin, Ethereum and XRP dip under key support levels at $60,000, $2,600 and $0.60 respectively. Tron ecosystem’s meme launchpad SunPump generates over $1.1 million in revenue within twelve days of its launch. Tron network daily revenue reached a record high of $26.83 million on Tuesday,…

Top 10 Cryptocurrencies To Invest in January 2024

-Michael Adams From Bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, making it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies based on their market…

The Risk And Reward Of ChatGPT In Cybersecurity

Juan is an experienced CTO with a demonstrated history of working in the computer and network security industry. He is an information technology professional skilled in SAP and Oracle applications, computer forensics, vulnerabilities research, IPS/IDS and information security. Unless you’ve been on a retreat in…